A lot of people new to the world of investing sometimes don’t know where to start, and it can perhaps seem quite daunting.

In this post we’ll go through where you can possibly start in your investment journey. Or if you’ve already started perhaps this post may offer some further direction in your investment journey.

What is investing?

According to Investopedia Investing simply put is: “the act of allocating resources, usually money, with the expectation of generating an income or profit”. You may simply choose to invest in either of the following:

- Real Estate (Buy-to-Let property)

- Stocks and Shares

- Fine Art

- Commodities (Gold, Silver etc)

This post will emphasise on stocks and shares

As I mentioned above, investing can appear boring to someone starting out, but what if you could perhaps make it more entertaining?

Assess your lifestyle and habits:

One of the easiest and first things you can do is consider what your consumptions are, and assess your current lifestyle:

I like Ketchup and Baked Beans

So for example are you someone that likes to shop for clothes? Do you like to eat takeaways outside etc. Based on these questions, it can influence your decision making for the type of investments you can make.

For example, I am someone who likes to have a full English breakfast which includes baked beans, I also like to eat out on occasions and I like my sauces, ketchup, mayonnaise, and BBQ sauce. I’m also aware that I’m not alone on this and there are many others who like to eat out and like their sauces too.

As a result I purchased Kraft-Heinz shares a couple years ago. Kraft-Heinz are the producers of the infamous Heinz ketchup and baked beans. After doing my own research on the company, I concluded that:

- I liked the company, due to their quality products and strong brand

- It has been around for years. Established in 1869. 150+ years ago!

- I was comfortable with their financials

- Their Profit and Loss over the past 5 years

- Their Assets (what the own) and liabilities (what they owe) over the last five years. Despite the fact that they had an accounting scandal in that period of time.

- Their ability to generate cash consistently through various economic cycles

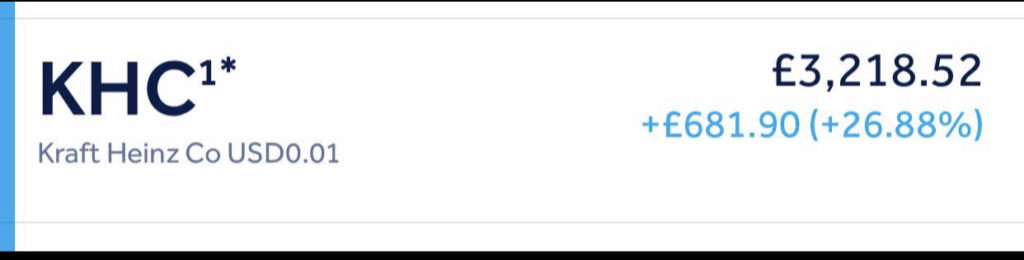

This is my current holding in Kraft-Heinz (KHC). I started this position over two years ago, in that time it went as high as 40%, and I have received dividends every quarter since buying them. With the dividends I have a choice of accumulating it to reinvest it back into the company, or I can use the dividend income to buy more Heinz products.

Detergents and other household utilities

I also have a stake in Unilever, they own another well-known mayonnaise brand in Hellman’s and they produce a bunch of other products, that my house hold consumes. From Vaseline to deodorants and detergents.

Hay fevers

Of recent, I’ve started to develop hay fevers and allergies to dust etc as a result I am considering investing a stake in a publicly traded company that specialises in products that combat hay fever and other allergies. I’ll keep you posted on that in subsequent blog posts.

Benefits of investing in companies whereby you consume their products:

Psychologically rewarding

I think this is a win win strategy for consumers and investors. There’s a chance that each time you consume a product that you’ve financially invested in you can benefit from this. This benefit can come through potential capital gains in your investment and income from dividends. Heinz is a global brand, and I believe that they’ll continue to do well, each time their products get consumed I get richer!

Imagine that ey! It’s nice knowing that, and if the company also pays dividends I’m literally “getting money while I’m sleeping”!! Each time I buy and use their products I also potentially increase my wealth as the value of my shares can increase if the company performs well, particularly based off their sales which I’m contributing to.

A more fun way to invest

As it is something you’re more than likely to have an interest in, otherwise you would be consuming the product, I think this will add the fun element to investing for sure. I think it’s a good starting point to consider investing in what you consume or like.

I’m constantly asking myself, and discussing with my friends ideas on our consumptions and how we can monetise it through investments in those companies. You’re probably more likely to have a better output on many things in life, when you have an interest in something, in this case a potential investment in a product you like and use.

Can help you make better investment decisions

I’m a big fan of investing in what you have knowledge in or understand. By investing in what you consume, you’re likely to have much more knowledge on the product than investing in something you don’t consume. This can help you make informed decisions to your investments for example, whether to sell your shares if you think the company is no longer remaining competitive, based off your consumer experience with their services and products.

Or whether to increase your stake in that company if you believe the company has potential to grow even further. As a result It can help you minimise any losses and potentially help increase your capital gains. By investing in what you consume, you are indirectly investing in something you have knowledge and understanding in.

Thought process and how to get started?

Below are further analysis that can help our decision making in product consumption and company investment:

Consider the theme.

This can be amongst the first things you think about. ‘Where is the world moving to?’, ‘How will this affect my daily habits and current lifestyle?’ For example, you can make a case that technology and climate change are two big influences that will affect our lifestyles and daily habits now and in the future. In addition to this consumers are now becoming more health conscious, veganism has exploded in recent years.

Identify the companies that have the biggest influence

What I mean by this is the companies that are more likely to be in pole position to take advantage of the those ‘themes’ mentioned in the previous point, this shouldn’t necessarily be a difficult task. For example as mentioned above technology is influencing our lives and will more likely to do so in the future. A company with huge influence in this field that comes to mind is Microsoft.

A lot of companies use Microsoft office products and services, from Microsoft Teams for meetings to artificial intelligence and it’s influenced the way companies work. Irrespective of whether you’re in sales, marketing, finance etc, this wouldn’t be a bad company to consider investing in. I have added them to my watchlist! – This is not an investment advice.

Practicality and real life examples

You can make a case that all the above points I mentioned are theoretical. In the this section we will talk about this from a practical perspective. In investing, overcomplication can hinder your chances of having a profitable portfolio. Keeping the thought process and decision making process simple should be at the forefront. We’ll see a case study on how investing based off product consumption and interest can be profitable.

The Peter Lynch study

Peter Lynch is a prolific investor. He was the investment manager of the Magellan fund at Fidelity which performed an average of 29.2% per year between 1977 and 1990! He was consistently outperforming the stock market at that time.

He observed a group of 13 year old students back in 1990. As part of their school work, the students were asked to pick stocks for a model portfolio (it wasn’t real money). Two years later the students’ stock portfolios produced a gain of 70%! While the U.S stock market gained 26% during this two year period. The students also managed to outperform 99% of all equity mutual funds.

How did this happen?

It turned out that these students followed a few key principles below:

- Know what the company does.

Before the students could pick any company stock, they had to explain to the class what the company does. They were not allowed to pick a stock if they were not able to tell the class the products or services their chosen company provides. As a result of this rule, the students subsequently picked Disney (The Walt Disney), The Gap inc and Nike inc.

- Invest in brands you know and love

“You should not buy a stock because it’s cheap, but because you know a lot about it”

The students apparently loved to shop at The Gap Inc. They reasoned their selection saying that other kids around the country probably felt the same way. The students clearly knew something others didn’t, The Gap Inc subsequently posted 320% gain for their portfolio.

The students added Pepsi and Wal-Mart to their portfolios making a gain of 64% and 164% gain respectively! It’s worth noting that not all their stock investments were successful, signifying that investments can fall in value as well as increase.

The students’ investment mantra was “You should not buy a stock because it’s cheap, but because you know a lot about it”

- Do your homework

This simply just comes down to doing your due diligence on the company of your choice. Inasmuch as liking a company’s’ product or service is a good start, it’s still wise to conduct your research on the company for example:

- Their profit or Loss over a period of time (5 years)

- Their competitive advantages

- Their assets (what they own) and liabilities (what they owe)

- Their competitors

Final Thoughts

Assuming you have done the necessary checks and homework, I truly believe that investing in companies you are a consumer/customer of can add the fun element to investing. As mentioned above and complemented by the case study of the students, your output is likely to be more profitable when passion, enthusiasm are an added input to the process.

Companies like this are definitely a good place to start investing especially if one doesn’t know where to start their investment journey from. One of Peter Lynch’s famous quotes is “if you like the store, chances are you’ll love the stock”.

“if you like the store, chances are you’ll love the stock”

If you’re still feeling cautious about making the first step to your investment journey, you have the option of testing the waters by either ‘drip feeding’ or opening an investment fantasy portfolio.

Drip feeding is essentially you investing a small amount each period (week, month, quarter) depending on how much you can afford and subject to the share price of a company. Nothing is too small, and we have all started somewhere.

A Fantasy portfolio is similar to what the students in the case study. It’s not real money, if you are still caution you can start by picking a handful of stocks in your fantasy portfolio based off the investment considerations mentioned above. This will give you an opportunity to monitor and assess your portfolio before you feel confident to fully commit real money. It’s never too late to start your investment journey. Just have an interest in the company, do some research, assess the associated risks and go for it!

Disclaimer: TheHustlingDad does not give out any financial advice. Please conduct your own research and know that investments are subject to decrease as well as increase.

Leave a Reply